The modified internal rate of return (MIRR), like the internal rate of return (IRR) is a measure of the return of an investment. MIRR assumes that all projects’ cash flows are reinvested at the cost of capital of the company, while the regular IRR assumes that the cash flows are reinvested at the IRR of their own IRR (the IRR of the project). Since using cost of capital as the reinvestment rate of the company is more accurate, the modified IRR can better indicate the project’s true profitability.

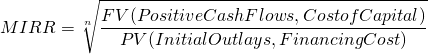

MIRR is defined as follows:

Where

![]() = Cash flows received from project

= Cash flows received from project

![]() = Future value of cash flows using the cost of capital as the interest rate

= Future value of cash flows using the cost of capital as the interest rate

![]() = Initial costs to start the project

= Initial costs to start the project

![]() =The internal rate of return (IRR) of the project.

=The internal rate of return (IRR) of the project.

For example:

For example, say a two-year project with an initial outlay of $200 and a cost of capital of 10%, will return $125 in the year 1 and $135 in year 2. First, we find the IRR of the project so that the net present value (NPV) = 0:

NPV = 0 = -200 + 125/(1+ IRR) + 135/(1 + IRR)2 NPV = 0 when IRR = 19.15%

To calculate the MIRR of the project, we assume that the positive cash flows are reinvested at the 10% cost of capital of the company. So the future value of the positive cash flows is calculated as:

125(1.10) + 135 = 272.5 = Future Value of positive cash flows at t = 2

Next, we devide future cash flow values ($125) by the present value of the initial outlay ($200) and and find the geometric return for 2 periods. Note that if any outlays occured past the beginning of the project, those outlays would have to be discounted to the present value using the IRR. In this case we only had one initial outlay of $200, therefore its present value is equal to $200.

=sqrt(272.5/200) -1 = 16.73% MIRR

In this instance, the 16.73% MIRR is lower than the IRR of 19.15%. In this case, the IRR shows an overly optimistic investment picture of the potential of the project, while the MIRR gives a more realistic evaluation of the project.

When to use MIRR vs IRR

It depends on the project. If project cash flows can be reinvested into the project to produce the same return, than the IRR is a more accurate indicator of the return of the investment. If the project cash flows cannot be reinvested back into the project, and are distributed back to the company, then the MIRR is a more accurate indicator of the return of the investment.